Compra criptomonedas al mejor precio

Disfruta de un proceso sencillo y seguro para comprar, vender e intercambiar criptomonedas.

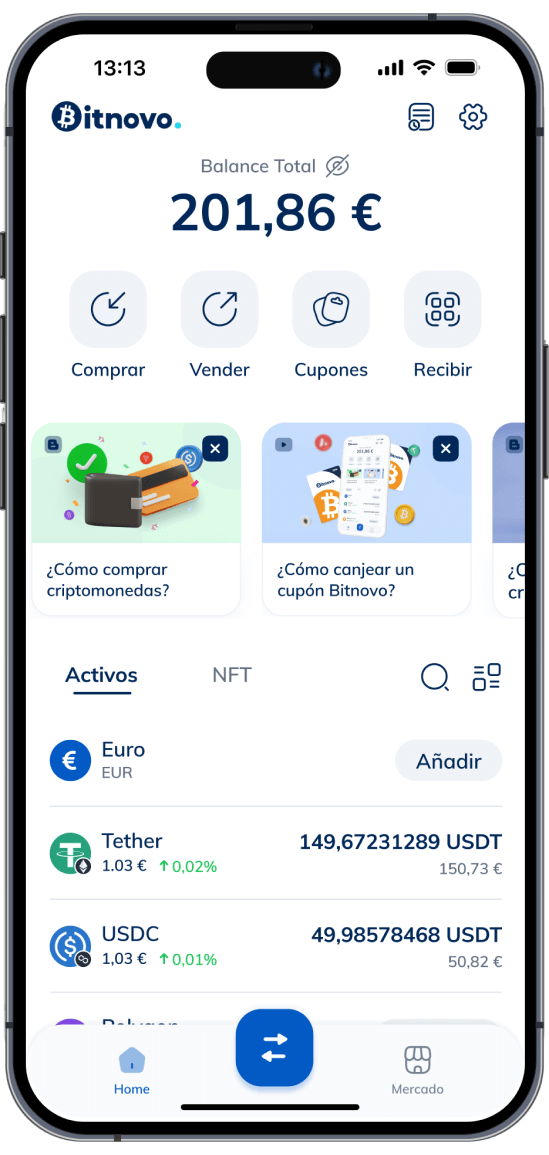

Toda tu cripto bajo tu control

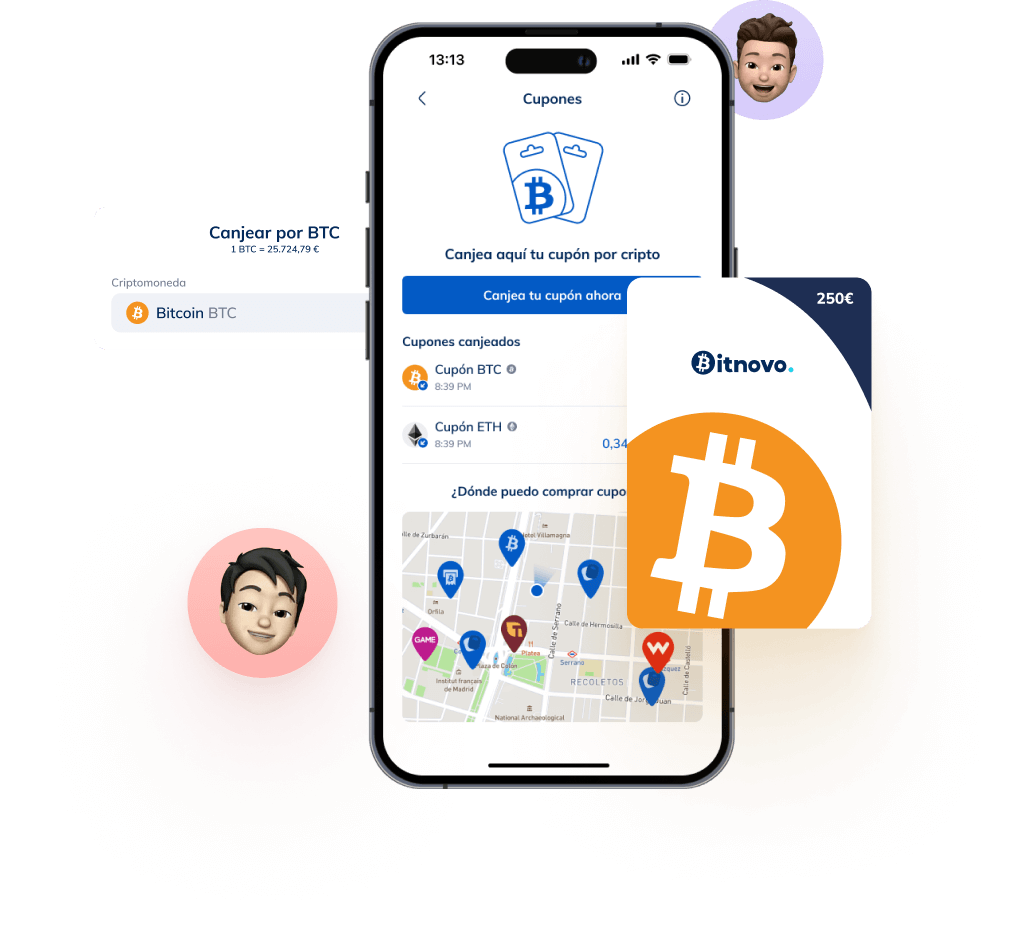

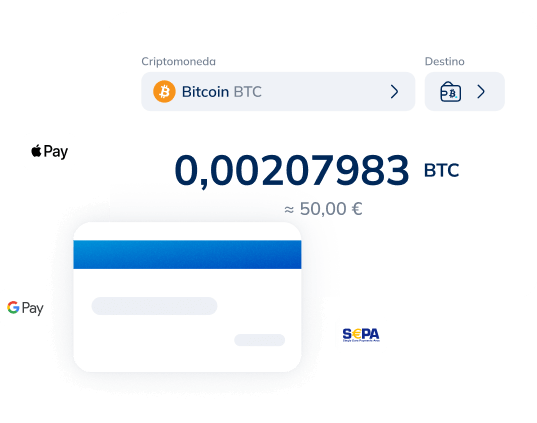

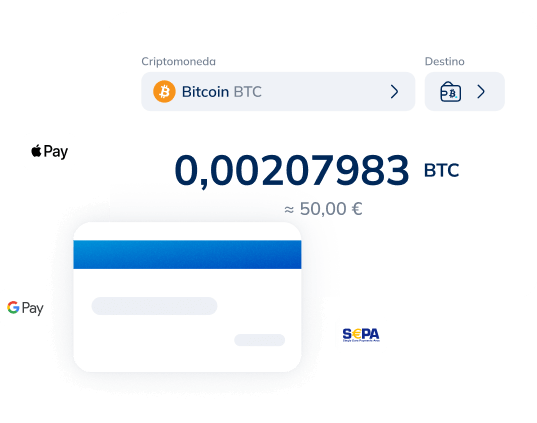

Compra como quieras

Adquiere criptomonedas pagando con el método que prefieras: con tarjeta, transferencia bancaria o canjeando nuestros cupones.

Vende cuando quieras

Recibe euros directamente en tu cuenta bancaria a través de transferencia instantánea en la zona SEPA.

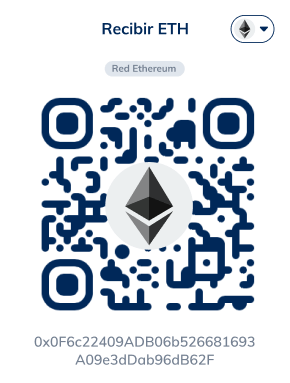

Envía y recibe cripto

Utiliza nuestro Wallet auto-custodio, con el cual podrás enviar y recibir criptomonedas sin límites y de forma segura, siendo tú el único dueño de tus activos.

Intercambia cripto al momento

Convierte la cantidad que necesites de una cripto, como por ejemplo Bitcoin, a cualquier otra de forma rápida, sencilla y sin necesidad de registro.

Retira tu cripto en efectivo

Vende tus criptomonedas y retira euros en efectivo en cualquiera de nuestros cajeros automáticos (ATM) o en nuestros puntos colaboradores.

Compra como quieras

Adquiere criptomonedas pagando con el método que prefieras: con tarjeta, transferencia bancaria o canjeando nuestros cupones.

Vende cuando quieras

Recibe euros directamente en tu cuenta bancaria a través de transferencia instantánea en la zona SEPA.

Envía y recibe cripto

Utiliza nuestro Wallet auto-custodio, con el cual podrás enviar y recibir criptomonedas sin límites y de forma segura, siendo tú el único dueño de tus activos.

Intercambia cripto al momento

Convierte la cantidad que necesites de una cripto, como por ejemplo Bitcoin, a cualquier otra de forma rápida, sencilla y sin necesidad de registro.

Retira tu cripto en efectivo

Vende tus criptomonedas y retira euros en efectivo en cualquiera de nuestros cajeros automáticos (ATM) o en nuestros puntos colaboradores.

Nuevas verticales para tu negocio

Bitnovo para empresas

Empodera tu negocio e implementa nuevos canales de ingresos utilizando nuestros servicios; cada día, más personas utilizan criptomonedas.