Price Solana (SOL)

Purchase price

0,00 €

Sale price

0,00 €

Variation

0 %

We update the prices of Solana in Spain in real time.

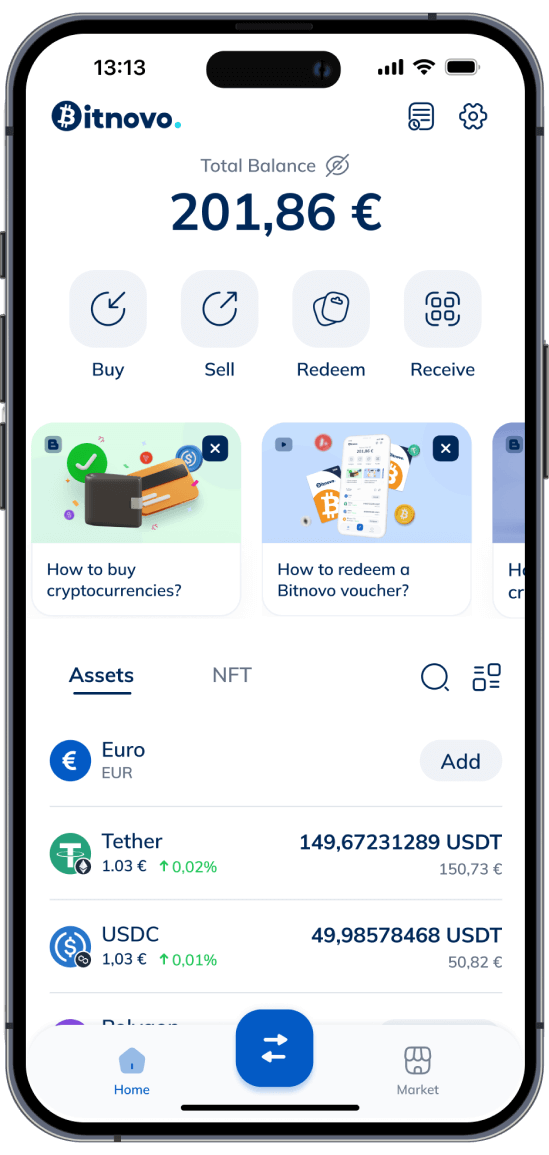

Buy SOL with Visa/MasterCard or via SEPA transfer. Create your account now and receive a promotional code.

Real time quote

Solana and Its Competition with Ethereum

Solana vs. Ethereum in Decentralized Applications

Solana has emerged as a direct competitor to Ethereum in the realm of decentralized applications (dApps). Its high speed and efficiency make it attractive to developers seeking a scalable and high-performance platform. Ethereum, on the other hand, is known for being a pioneer in smart contracts and dApps but has faced scalability issues and high transaction fees.

Solana vs. Ethereum in NFTs and DeFi

In the world of non-fungible tokens (NFTs) and decentralized finance (DeFi), Solana has gained ground against Ethereum. Solana's technology allows for fast and inexpensive transactions, making it attractive for projects requiring high transaction frequency, such as NFT markets and DeFi protocols. Ethereum, while a leader in these fields, has faced criticism for network congestion and high transaction costs.

More about Solana

Features of the Solana Protocol

The Solana protocol stands out for its hybrid consensus model that combines Proof of History (PoH) and Proof of Stake (PoS), enabling high scalability and transaction speed. This unique combination has positioned Solana as a direct competitor to Ethereum in the world of cryptocurrencies.

Transaction Speed in Solana

The combination of PoH and PoS in Solana not only ensures scalability but also an impressive transaction speed. With a processing capacity of up to 65,000 transactions per second, Solana stands out for its efficiency and speed compared to other blockchains.

The Importance of Scalability in Solana

Solana is known for its high scalability, meaning it can handle a large volume of transactions efficiently and quickly. Scalability is fundamental in blockchain networks, especially when it comes to decentralized applications and real-time transactions.

Investment Opportunities in Solana

Investing in Solana offers interested parties the opportunity to participate in a high-performance blockchain platform with growth potential. Below are the available opportunities detailed:

Risks and Recommendations for Investing in Solana

Investing in cryptocurrencies involves inherent risks, including market volatility and potential fraud or security incidents.

It is essential to research and understand how Solana works, as well as to stay informed about potential updates and relevant news that may affect its price.

It is recommended to diversify your investment portfolio and not to allocate an excessive amount of capital to a single asset like SOL tokens.

Security Incident in Solana

Recently, Solana experienced a severe security incident that resulted in the theft of approximately 8 million dollars in SOL tokens from about 8000 wallets. This event caused uncertainty among the network's users and investors, calling into question Solana's security and reliability as a blockchain platform.

Security Measures in the Solana Network

Following the incident, the Solana Foundation implemented additional security measures to strengthen the network and protect user funds. Thorough audits were conducted to identify potential vulnerabilities, and Solana's security protocol was updated.

Users are advised to keep their wallets and private keys secure, enable two-factor authentication, and use strong passwords. Additionally, it is recommended not to share confidential information and to be vigilant against potential phishing attempts or other forms of fraud.

The Solana Foundation has worked closely with cybersecurity experts to enhance network protection and ensure transaction integrity. These initiatives aim to restore the community's trust in Solana and demonstrate its commitment to the security of digital assets.

Start shopping SOL

Once the checks have been made, in less than 30 minutes you will receive the cryptos in your wallet.

Cryptocurrencies Rising and Falling

Top Best Performers

Top Worst Performers

Price of all cryptocurrencies

See more