Table of Contents

ToggleHere, no nonsense—I’m going to drop the raw truth about Uniswap, the damn engine driving the DeFi game today. If you want to know what Uniswap is, you’ve hit the jackpot. In 2025, this protocol is no longer what it used to be. That whole “trendy decentralized exchange” thing is outdated. Now we’re talking about the mother of all DEXs.

Uniswap is the most badass DEX (decentralized exchange) in the crypto ecosystem and I’m not debating that with anyone. To start with, it allows token swaps without middlemen, without banks ripping you off with astronomical fees, and without waiting hours for your transaction to be processed.

With the launch of Uniswap V4 in January 2025, this platform had an insane glow-up and is now a cross-chain ecosystem handling billions in daily volume. Mind-blowing. Honestly, it makes traditional exchanges look like dinosaurs.

It’s no secret that both on Ethereum’s blockchain and similar blockchains, there’s a huge revolution shaking up the financial industry. But I’d dare say Uniswap is the most interesting project built on these foundations.

Basically, it’s a protocol allowing buyers and sellers to swap tokens via smart contracts—without using an exchange or relying on an order book.

In short: Uniswap is where traditional money flatlines and where smart contracts make sure you don’t get scammed… well, at least not by middlemen.

The history and evolution since 2018: From unicorn to wolf

It all started pretty lite. Uniswap was designed to provide two services: on one hand, being a DEX (decentralized exchange) within Ethereum’s ecosystem, and on the other, to serve as an automated liquidity protocol (AMM).

This story begins with Hayden Adams. This guy had lost his job and one day stumbled upon Vitalik Buterin’s revolutionary ideas about AMMs back in 2017. The project took off after a series of posts made by Vitalik (Ethereum’s creator) in 2017 and 2018. In the first, he hinted at building a DEX on Ethereum, and in others, he spoke about AMMs.

Uncle Hayden Adams saw these ideas and thought: “Damn! Perfect for my unicorn.” So, he created Uniswap and turned it into what it is now: one of the biggest DeFi systems on Ethereum.

The funniest thing is nobody expected this experiment to end up eating the lunch of traditional banks. Spoiler: that’s exactly what happened—meanwhile banks are still stuck with faxes and paper forms.

To give you better perspective, here’s Uniswap’s insane evolution:

-

V1 (2018): The experiment that kickstarted AMMs

-

V2 (2020): More versatile pools (token/token), flash swaps, and stronger fundamentals

-

UNI Token (2020): The governance token that changed everything

-

V3 (2021): Concentrated liquidity and capital efficiency to the max

-

V4 (January 2025): Customizable Hooks, modular architecture, and up to 99% gas reduction when creating pools. The ultimate beast.

Meanwhile, traditional banks kept obsessing over whether Bitcoin was a fad, but Uniswap was already on its fifteenth version rewriting the entire system XD.

How does Uniswap work? The DEX and AMM that makes you win (or lose)

There’s tons to say about Uniswap, but I don’t want to bore you, so I’ll keep it brief. As I was saying, Uniswap has two main angles: being a decentralized exchange (DEX) and offering an automated liquidity protocol (AMM).

The Uniswap DEX works like most exchanges, not rocket science. Someone wants to swap one crypto for another, and the exchange makes it happen. The difference in Uniswap is that this is done in a decentralized way via smart contracts.

For clarity, let’s put an example: imagine you want to swap your tokens, and instead of waiting for someone to buy them, here you just drop yours in—done! The smart contract automatically pairs them off. This way, users keep full control of their funds. On top of that, the liquidity providers are quite a massive base, meaning swaps are fast. It’s lightning quick.

Now onto the AMM model—this is Uniswap’s strongest point, where it completely knocks other exchanges out. It runs a system called Constant Product Market Maker (CPMM). With V4, this became even more flexible thanks to “Hooks” that enable customizable features. Some quick examples: limit orders, auto-rebalancing, or smart liquidity management.

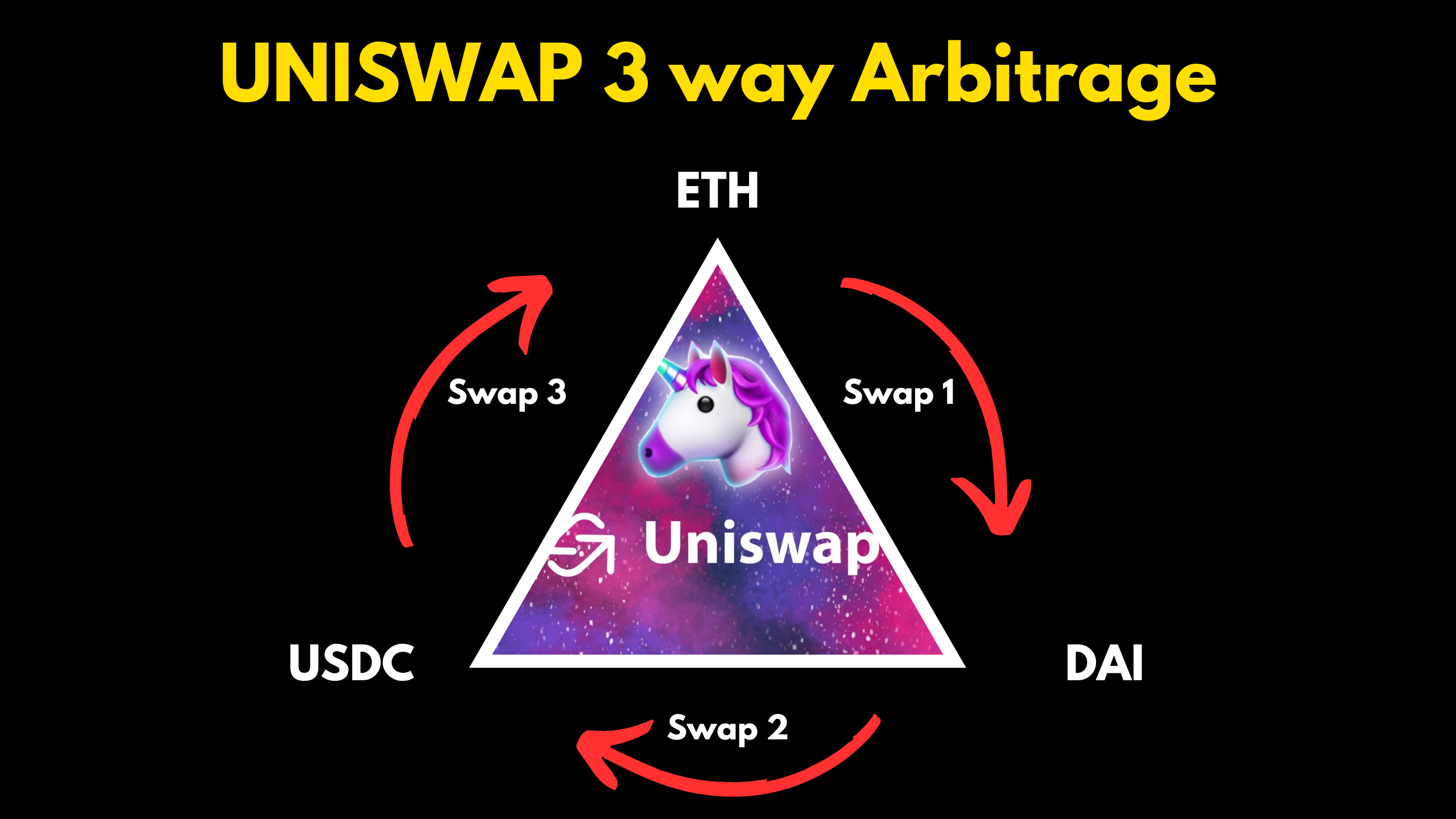

In short, hundreds of users like you throw their crypto into a liquidity pool of any pair (say DAI/ETH). That money is used by others who want to swap.

Of course, everyone benefits here. In return, depositors earn a cut of transaction fees, depending on how much they contributed. With the improvements in V4, fees are now dynamic and can auto-adjust to market volatility.

Cool stuff—but watch out for gas. It still hurts newbies who don’t know squat. That said, with V4 gas fees dropped by around 30%, and creating new pools is 99.99% cheaper than in previous versions. Not bad Uniswap, keep it up.

Liquidity pools and yield farming in 2025: How to make money without getting wrecked

As I said, the goal of Uniswap pools is to collect liquidity from some users so others can trade smoothly. In 2025, liquidity mining is still the goldmine for risk-takers, and V4 is the steroid shot it needed.

Pools work pair-by-pair, meaning the depositor provides two tokens (like ETH and DAI). With V4, Hooks enable more advanced strategies: pools that auto-rebalance, charge variable fees based on market conditions, or execute limit orders automatically. Stop imagining—it’s real. Well, technically it’s AI, but it exists.

For example, if liquidity providers open a DAI/ETH pool, they deposit value in both DAI and ETH. Once created, the pool is listed so users can trade that pair.

Let’s make it simple with a real case: imagine Iniesta uses Uniswap to swap 50 DAI for ETH. He goes to the DAI/ETH pool, submits a swap, and waits for it to execute.

Even though gas has dropped thanks to Ethereum upgrades and L2 rollups, there’s still risk. Don’t sell your house for this. That DAI/ETH pool will take Iniesta’s 50 DAI and send him back $50 worth of ETH. Liquidity shifts accordingly: -$50 in ETH, +50 DAI.

Sounds nice, but don’t forget: DeFi isn’t for fools. If you get burned by impermanent loss or rugpulls, don’t come crying. I keep telling you in every article—don’t invest more than you’re willing to lose. If you actually read me…

UNI: The token that doesn’t just vote, it pays out cash

People recall UNI as a governance token, but it’s long surpassed that. I mean, yeah, it still is, but it’s way more. UNI now plays a key role in DeFi governance, yields, and influence. Basically, UNI gives governance over Uniswap protocol—but also a ton of extra functions.

Know this: it’s an ERC-20 token running on Ethereum. What did you expect? I already told you it was Buterin-based. See? You don’t pay attention. This token also controls the UNI community treasury and protocol fee changes.

Holding a bit of UNI is like being a mini-king in this jungle. You can vote on protocol directions, and now with V4’s new features, UNI holders can also share in protocol revenue through enhanced fee sharing.

The original idea behind UNI was to pump liquidity into the struggling project by rewarding users with tokens. That basically saved it from becoming “just another DEX.” The main aim was to support liquidity mining.

The token launched on September 16, 2020, via airdrop. Now it stands in its latest evolution: Uniswap V4 (January 2025). UNI was also meant for voting on major decisions.

In V4, new elements have been added—while governance stays its main role, UNI also gives voting power over protocol directions, fee changes, and approval of new Hooks.

Though UNI itself hasn’t changed radically, owning it means having a voice in how this DeFi beast evolves—now including customizable Hooks and cross-chain power. Not too shabby, huh?

Pros and cons in 2025: Worth diving in?

Hold your horses, Ricky Martin—you’re already dreaming of buying 1500 UNI but that’s not how this goes. First, check pros and cons. Here’s a simple, no-BS list:

Pros of Uniswap

-

Decentralized to the core

-

Swap any ERC-20 token or tokens across multiple blockchains

-

Open source

-

Trading is cheaper than ever with V4

-

Liquidity pools deliver great yields (with big investment)

-

Up to 99% gas reduction for pool creation, 30% for swaps

-

Native ETH support saving extra gas

-

Dynamic fees that auto-adjust to volatility

Cons of Uniswap

-

Ethereum still isn’t perfect—gas can still bite, though far less than before

-

The protocol is always evolving like most DeFi, which means risk remains high

-

Beware of scams and fake tokens still circulating

-

V4 Hooks add complexity and possible new attack vectors (think open doors for hackers)

Here, you either eat or get eaten. The fun part about DeFi in 2025 is that smart players can stack big profits, but clueless tourists leave broke (and with holes in their pockets).

Uniswap beyond Ethereum: Interoperability and the future

Time to unchain Uniswap from Ethereum—it needs some air. Yes, it’s an Ethereum DEX, we get it, but it’s gone way beyond that. It’s literally a global mega-ecosystem.

By 2025, Uniswap expanded to a much broader system. It’s now multichain, using solutions like UniswapX to integrate liquidity on-chain and off-chain. This allows token swaps across multiple blockchains.

Uniswap also has a strong presence in Arbitrum (an Ethereum scaling solution) with lower fees and faster confirmations.

Although Ethereum remains the foundation, Uniswap is integrating with multiple networks to expand reach and efficiency—day by day proving it.

Also worth highlighting are UniswapX and liquidity aggregation. UniswapX integrates on/off-chain liquidity, while liquidity aggregation pulls sources from everywhere so users get better prices and less slippage.

Should you ride the unicorn or step aside?

Let’s keep it real: Uniswap in 2025 isn’t for everyone—only if you know what you’re doing. Then it can be your best DeFi ally.

Use it if you have basic DeFi knowledge or can afford to lose your investment. If you’re chasing higher yields than banks and don’t fear volatility, you’ll like it here.

But if you’re new to crypto, need that money for life expenses, or panic at a 10% swing—better tread carefully or stick to a savings account.

This is wild DeFi: diamond hands only. Winners are those who learn, diversify, and understand it’s a marathon, not a sprint. This isn’t financial advice—it’s raw truth. Uniswap V4 turned this platform into DeFi’s Swiss army knife: more efficient, cheaper, customizable, and stronger than ever. But it’s still DeFi—where you can multiply your money or lose it all in one afternoon.